Understanding per diem meaning is essential for employees, travelers, and employers alike.

If you’re a nurse taking per diem shifts, a business traveler receiving a daily allowance, or someone managing loans, knowing how per diem allowances work can save you time, money, and confusion.

In this guide, we’ll dive deep into everything related to per diem, from pronunciation to industry-specific usage, finance applications, and job benefits.

What is Per Diem?

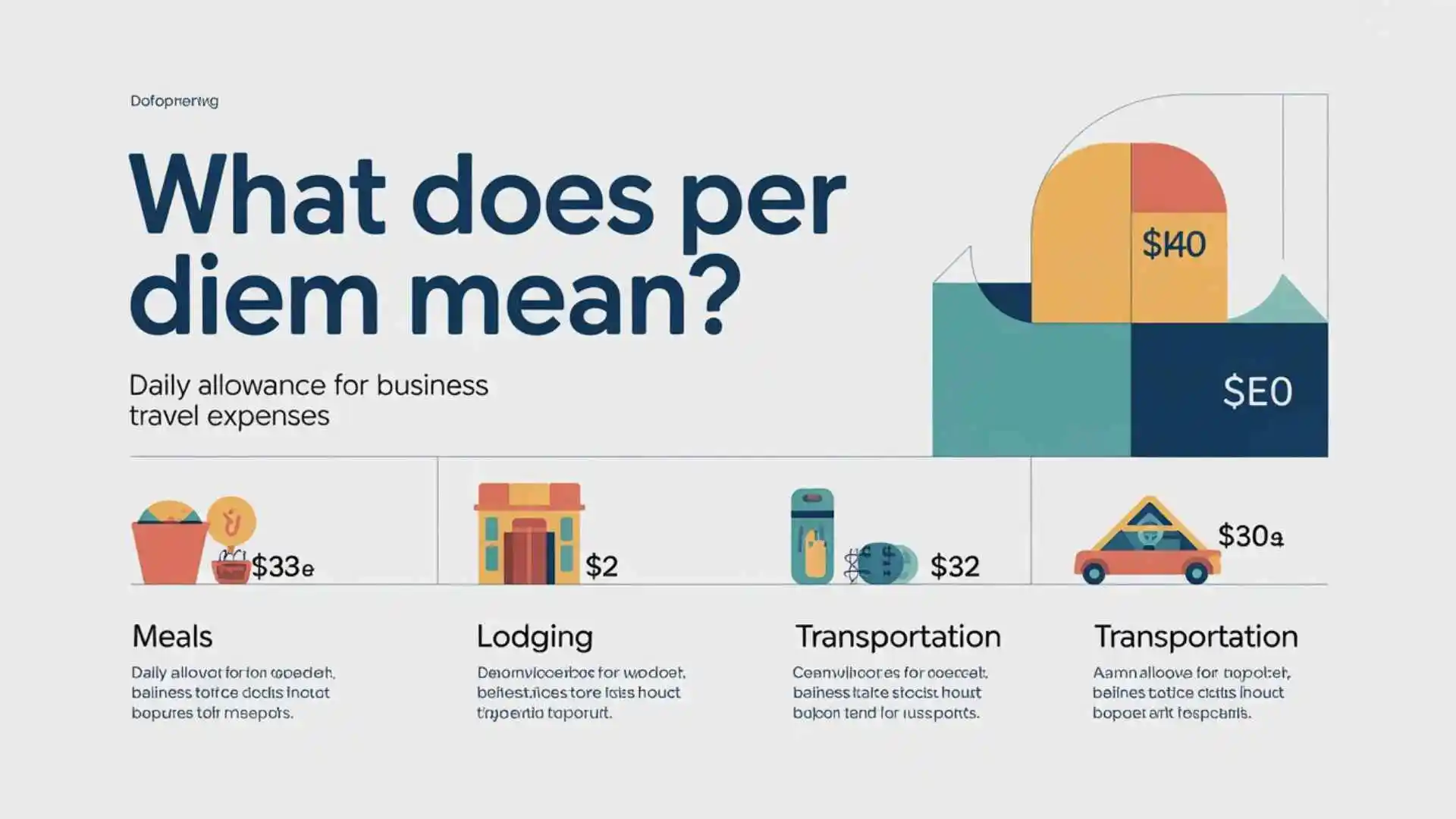

At its core, per diem is a Latin term that translates to “per day.” It refers to a fixed daily allowance given to cover expenses such as meals, lodging, or incidentals while traveling for work or performing job duties away from home.

The per diem pronunciation is simple: /pər ˈdiː.ɛm/. Most people read it as “per DEE-em.”

Unlike a salary or hourly wage, per diem allowances are not necessarily tied to hours worked. Instead, they compensate for daily expenses incurred while performing work-related duties.

Example: A marketing consultant traveling for a week might receive $120 per day as a per diem allowance to cover meals and transportation.

Types of Per Diem Allowances

Per diem allowances can vary depending on the organization, industry, or purpose of travel. The main types include:

- Meals and Incidentals (M&IE): Covers food, tips, laundry, and minor expenses.

- Lodging: Daily accommodation costs while traveling.

- Transportation or Travel Allowances: Covers local transit, taxis, or fuel.

| Type | Typical Coverage | Example Amount (USD) |

| Meals & Incidentals | Breakfast, lunch, dinner, tips | $60/day |

| Lodging | Hotel room, taxes | $150/day |

| Transportation | Taxi, Uber, fuel, parking | $40/day |

Government agencies often publish standard per diem rates, but private companies may set their own.

Per Diem in Employment

What is a Per Diem Job?

A per diem job refers to work where employees are paid daily allowances instead of a fixed salary. These jobs are common in healthcare, construction, and transportation, offering flexibility for employees.

Advantages of a Per Diem Job:

- Flexibility to work on-demand

- Higher daily pay rates in some industries

- Opportunity to work multiple jobs

Disadvantages:

- Limited or no employee benefits

- No guaranteed work hours

- Less job security

Example: Nurses often work per diem shifts at multiple hospitals to increase income and schedule freedom.

How Per Diem Works for Employees

When a company provides per diem for employees, it’s usually for reimbursing daily work expenses incurred while traveling or working outside the main office.

- Per diem for work expenses is tax-free if it follows IRS guidelines.

- Employees submit receipts for certain expenses if allowed.

- Many companies have a per diem policy outlining daily rates and eligible expenses.

Sites like Indeed list thousands of per diem jobs, from healthcare to construction, making it easier to find work that fits your schedule.

Per Diem in Finance

Per Diem on a Loan

In finance, per diem on a loan refers to the daily interest accrual on outstanding loan balances. It’s used to calculate interest charges if a loan is paid off early or during short periods between billing cycles.

Formula for Daily Interest on a Loan:

Daily Interest = Loan Balance × Annual Interest Rate ÷ 365

Example:

- Loan balance: $10,000

- Interest rate: 6% per year

Daily interest: 10,000 × 0.06 ÷ 365 ≈ $1.64/day

Per diem on a car loan works the same way. Lenders may charge this per diem on a loan payoff to ensure interest is covered up to the payoff date.

Why It Matters: Understanding loan per diem calculation helps borrowers avoid unexpected charges and plan payoff dates effectively.

Per Diem in Healthcare

Healthcare is one of the largest sectors offering per diem jobs.

Per Diem in Nursing

Per diem in nursing refers to nurses who work on-demand shifts rather than full-time schedules.

Benefits:

- Flexible schedule

- Higher pay per shift

- Experience across multiple facilities

Typical Per Diem Nurse Rates (USD):

| Role | Average Per Diem Rate |

| Registered Nurse (RN) | $35–$60/hr |

| Licensed Practical Nurse (LPN) | $25–$40/hr |

| Certified Nursing Assistant (CNA) | $18–$28/hr |

Per Diem in Hospitals

Hospitals hire per diem staff to fill shifts during high demand, holidays, or staff shortages. Per diem in a hospital may include full benefits for the day’s work, including overtime or premium pay.

Per diem in healthcare jobs can also include administrative or billing roles. For example, per diem in medical billing allows professionals to work flexible hours handling patient invoices and insurance claims.

Per Diem in Specific Industries

Per Diem in Welding, Construction, and Trucking

- Per diem in welding: Welders working at multiple job sites may receive daily allowances to cover lodging and meals.

- Per diem in trucking: Long-haul drivers often receive a per diem travel allowance for fuel, food, and lodging on the road.

- Per diem in construction: Daily allowances cover meals or lodging if workers travel far from home.

Example Table: Industry Per Diem Rates (USD/day)

| Industry | Average Daily Per Diem | Notes |

| Welding | $75–$120 | Travel to multiple sites |

| Trucking | $50–$100 | Fuel & food included |

| Construction | $60–$110 | Lodging may vary |

When is Per Diem Required to be Paid?

Employers must provide per diem allowances when:

- Employees travel for work

- Employees work outside their regular job location

- Company or federal policy mandates daily reimbursements

IRS Guidelines: In the U.S., per diem payments are tax-free if they follow government rates for travel and meals. Excess per diem may be taxable.

Per Diem Policies and Reimbursements

A per diem policy ensures clarity for both employees and employers. Key components include:

- Daily rates for meals, lodging, and incidentals

- Eligible expenses and reimbursement limits

- Submission requirements (receipts, forms)

- Tax treatment

Example of Per Diem Reimbursement Process:

- Employee travels for a client project.

- Uses daily per diem allowance for meals and hotel.

- Submits a per diem report with dates and amounts.

- Employer reimburses or covers expenses according to company policy.

Common Questions About Per Diem

How is Per Diem Different from Travel Allowance?

- Per diem: Fixed daily payment based on rates.

- Travel allowance: May cover exact expenses, requiring receipts.

Is Per Diem Taxable?

- Tax-free if it follows IRS guidelines.

- Excess or non-qualified amounts are taxable.

Can Per Diem Be Negotiated?

Yes, especially for high-demand per diem jobs in healthcare or specialized industries.

How Does Per Diem Affect Paycheck?

- Direct daily allowance may appear separately from regular wages.

- Tax implications depend on company policy and federal regulations.

Conclusion

Understanding what does per diem mean goes beyond a simple definition. Whether you’re navigating per diem jobs, managing loans, or handling healthcare reimbursements, knowing how per diem allowances work empowers you to make informed financial and career decisions.

From daily rates in construction, trucking, and welding to per diem in nursing jobs, this guide covers all aspects you need to know. Always check your employer’s per diem policy or government rates to ensure proper compensation and compliance.

Asher Blake is a passionate wordsmith whose pen dances between pain and purpose. Known for his emotionally rich quotes and soul-stirring reflections, Asher has become a quiet force in the world of inspirational writing. His words don’t just decorate pages — they reach into hearts, offering comfort, clarity, and courage.

With a background in creative writing and an unshakable love for literature, Asher began his journey by collecting forgotten feelings and turning them into lines that linger. His work touches on self-worth, healing, love, heartbreak, and the small moments that define us. He believes that even a single sentence can light up someone’s darkest day.

Driven by empathy and depth, Asher Blake writes not to impress — but to connect. His quotes are shared across the globe by those searching for meaning, motivation, and emotional release. Whether you’re lost in love, rebuilding your confidence, or simply pausing to breathe, his words feel like they were written just for you.

Books by Asher Blake

“Ink & Ache: Quotes That Feel Like Scars”

A collection of raw, emotional quotes about love, loss, and becoming whole again.

“Still Learning to Breathe”

An inspiring blend of healing quotes and reflections for anyone learning to let go.

“Unfinished Thoughts”

A poetic journey through scattered emotions, fleeting moments, and the beauty of not having all the answers.